Medicare Advantage Enrollment | How to Sign Up

Understand the key enrollment windows, what to do during your Initial Enrollment Period (IEP), and how to avoid gaps or late enrollment penalties.

Quick takeaway

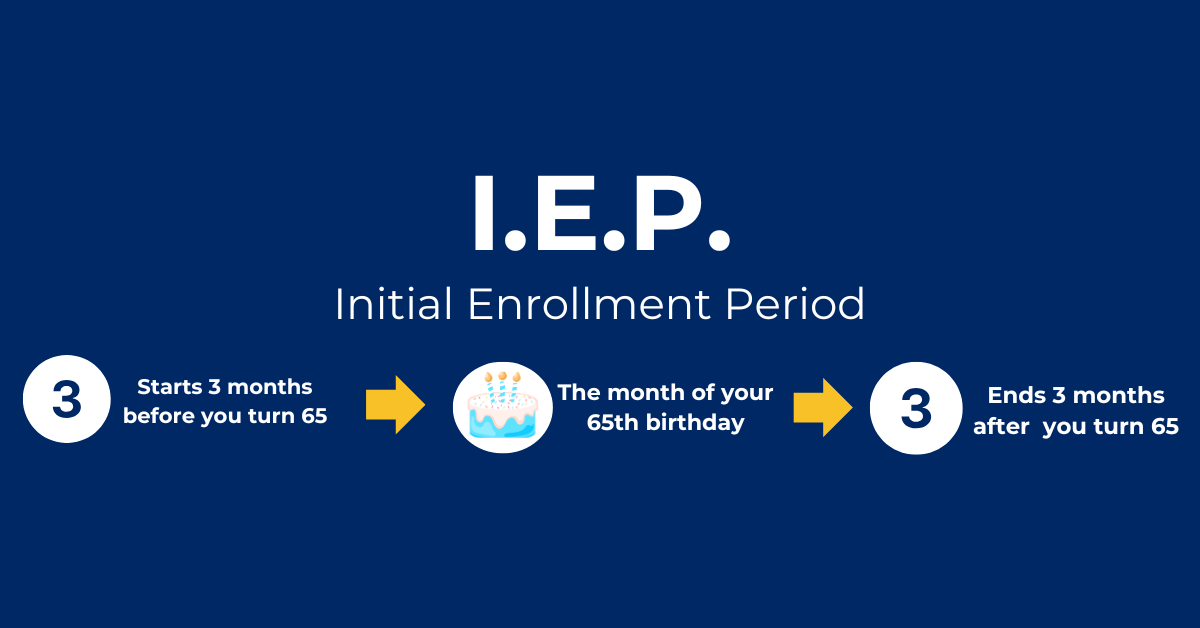

Enrolling in Medicare for the first time starts with understanding your Initial Enrollment Period (IEP). This seven-month window determines when you can join Medicare without facing late enrollment penalties. Knowing your timeline helps you avoid gaps in coverage and stay informed about your options.

Enrolling in Medicare for the First Time: Your Simple Guide

Your Medicare journey begins with your Initial Enrollment Period (IEP). This seven-month window includes:

- Three months before your 65th birthday

- The month of your 65th birthday

- Three months after your 65th birthday

During this time, you may sign up for Medicare Part A and Part B. Many people enroll as soon as they become eligible, while others may qualify for delayed enrollment depending on employment.

What Happens If You Delay Enrollment?

If you have group health insurance through your employer or your spouse’s employer, you may qualify to delay enrolling in Medicare Part A and Part B without late enrollment penalties.

Medicare Advantage Enrollment Options

Once you apply for Original Medicare (Part A and Part B), you can choose additional coverage, such as:

- Medicare Advantage Plans (Part C): Offered by private insurers and bundle your Part A, Part B, and often Part D benefits.

- Medicare Prescription Drug Plans (Part D): Stand-alone drug plans that help cover medication costs.

Pro Tip: Choosing the right plan during your IEP helps you avoid gaps in coverage and reduces the risk of late penalties.

Speak to a Licensed Sales Agent

Want help reviewing plan options available in your county, deadlines, and what to check before enrolling? We’ll walk you through it clearly.

Medicare Advantage Enrollment | Annual Enrollment Period (AEP)

Learn what you can do during AEP, what happens during MA Open Enrollment (MA OEP), and examples of Special Enrollment Periods (SEPs).

Quick takeaway

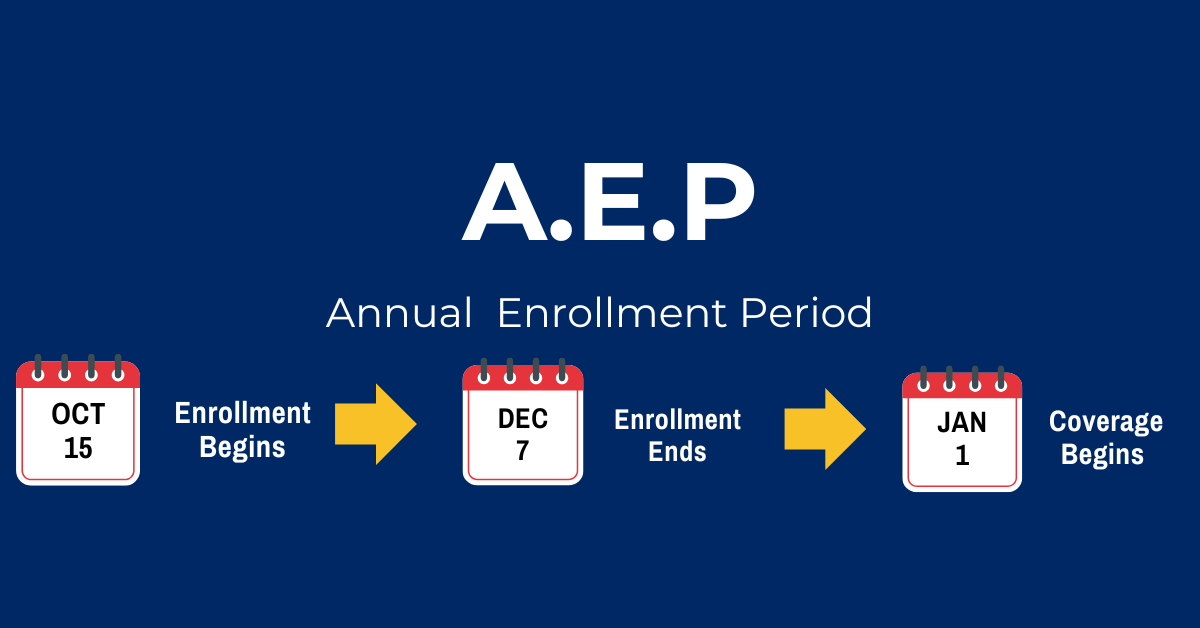

The Annual Enrollment Period (AEP) runs from October 15 to December 7 each year. During this window, you can enroll, change, or cancel your Medicare plan. The plan you select becomes effective on January 1 of the following year.

Medicare Advantage Open Enrollment Period (MA OEP)

MA OEP runs from January 1 to March 31 each year. This period is only for people already enrolled in a Medicare Advantage plan, and allows one plan switch.

MA OEP gives enrollees time to assess whether their current plan still fits their needs. If another Medicare Advantage plan is more appropriate, you can make a one-time switch, typically effective the first day of the next month.

Special Enrollment Periods (SEPs)

Special Enrollment Periods apply to certain life events such as relocating or losing employer coverage.

Examples include:

- Moving to a new area with different plan options

- Losing employer or union health coverage

- Becoming eligible for Medicaid or Extra Help

Important: Report qualifying life events promptly to avoid delays in coverage.

Final Steps for Successful Medicare Advantage Enrollment

To simplify the process, follow this checklist:

- Mark your IEP dates: Plan to enroll during your seven-month window.

- Review your coverage needs: Decide whether you need Medicare Advantage, Part D, or both.

- Track deadlines: Stay aware of AEP, MA OEP, and possible SEPs.

- Consult with an expert: Speak to a Medicare advisor for personalized guidance.

Enrolling in Medicare doesn’t have to be stressful. Understanding your enrollment timelines and comparing options helps you make confident decisions.

Have questions? You can always give us a call — we’re here to guide you through Medicare Advantage enrollment.